Papal indulgence of OECD thugs

August 30, 2007

Walter E. Williams - London's Times Online recently reported that, according to Vatican sources, Pope Benedict XVI is working on his second encyclical, a doctrinal pronouncement that will condemn tax evasion as "socially unjust." (See www.timesonline.co.uk/tol/comment/faith/article2237625.ece ) The pontiff will denounce the use of tax havens and offshore banking by wealthy individuals because it reduces tax revenues for the benefit of society as a whole.

Pope Benedict could benefit from a bit of schooling. Tax avoidance is legal conduct whereby individuals arrange their affairs to reduce the amount of income that is taxable. Tax avoidance can run the gamut of legal acts, such as investing in tax-free bonds, having employer-paid health plans, making charitable gifts, quitting a job and banking in another country. Tax evasion refers to the conduct by individuals to reduce their tax obligation by illegal means. Tax evasion consists of illegal acts such as falsely claiming dependents, income underreporting and padding expenses.

Pope Benedict's second encyclical puts him squarely in company with a group of thugs known as the Organization for Economic Cooperation and Development (OECD), an international bureaucracy headquartered in Paris and comprised of 30 industrial nations, mostly in Western Europe, the Pacific Rim and North America. One OECD report said low-tax nations are bad for the world economy and named 35 jurisdictions as guilty of "harmful tax competition."

Pope Benedict's second encyclical puts him squarely in company with a group of thugs known as the Organization for Economic Cooperation and Development (OECD), an international bureaucracy headquartered in Paris and comprised of 30 industrial nations, mostly in Western Europe, the Pacific Rim and North America. One OECD report said low-tax nations are bad for the world economy and named 35 jurisdictions as guilty of "harmful tax competition."To the OECD, harmful tax competition occurs when a nation has taxes so low that saving and investment are lured away from high-taxed OECD countries. The countries they've identified as tax havens, having strong financial privacy laws and low or no taxes on certain activities, include Panama, the Bahamas, Liberia, Liechtenstein, the Marshall Islands and Monaco.

The OECD demands these nations, as well as offshore financial centers in the Caribbean and the Pacific, in effect surrender their fiscal sovereignty and act as deputy tax collectors for nations like France and Germany. This would be a dream for politicians and bad news for the world's taxpayers. Fortunately, the hard work of the Center for Freedom and Prosperity has stymied the OECD's proposed tax cartel.

Pope Benedict shares some of the OECD goals in its attack on low-tax jurisdictions. To support their welfare states, European nations must have high taxes. Government spending exceeds 50 percent of the gross domestic product (GDP) in France, Sweden, Germany and Italy.

If Europeans, as private c

itizens and businessmen, relocate, invest or save in other jurisdictions, it means less money is available to be taxed to support their welfare states.

itizens and businessmen, relocate, invest or save in other jurisdictions, it means less money is available to be taxed to support their welfare states.The pope expresses the same concern in saying tax havens reduce revenues for the benefit of society as a whole. Survival of an ever-growing welfare state requires an assault on jurisdictional tax competition.

[See: Martin De Vlieghere, Paul Vreymans and Willy De Wit, "The Myth of the Scandinavian Model", The Brussels Journal (11/25/05) at: http://www.brusselsjournal.com/node/510 .]

[THIS IS A FALSE PRETENSE-BASED JUSTIFICATION FOR TRANSATLANTIC, AND EVEN GLOBAL REGULATORY AND TAX HARMONIZATION. THIS WAY, EUROPEAN INDUSTRIES IN HIGH-TAX JURISDICTIONS WILL NO LONGER BE AT A COMPETITIVE DISADVANTAGE. IT IS WHAT THE EUROPEAN COMMISSION AND PRESIDENTIAL CANDIDATES CLINTON & OBAMA REFER TO AS, 'LEVELING THE PLAYING FIELD'.

IT IS ALSO WHAT UK PRIME MINISTER REFERRED TO IN HIS RECENT SPEECH AT THE JFK LIBRARY AS MORAL / ETHICAL JUSTIFICATION FOR EACH NATIONS' CITIZENS BEING THEIR BROTHERS' KEEPER ALL AROUND THE WORLD.

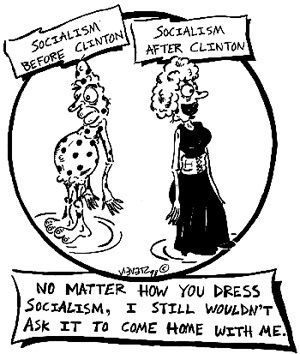

IT IS ALSO WHAT UK PRIME MINISTER REFERRED TO IN HIS RECENT SPEECH AT THE JFK LIBRARY AS MORAL / ETHICAL JUSTIFICATION FOR EACH NATIONS' CITIZENS BEING THEIR BROTHERS' KEEPER ALL AROUND THE WORLD.BUT, NO MATTER HOW YOU DRESS IT UP (OR 'SEX IT UP', TO BORROW A PHRASE FROM FORMER UK PRIME MINISTER TONY BLAIR), EUROPEAN-STYLE REGULATION & TAXATION REGIMES REMAIN UNDESIRABLE. WHY THEN WOULD MADAME CLINTON AND MONSIEUR OBAMA BE DARING ENOUGH TO IMPOSE THEM HERE IN THE U.S.??]

There's a more fundamental question I would put to the pope: Should the Roman Catholic Church support the welfare state? Or, put more plainly, should the Church support using the coercive powers of government to enable one person to live at the expense of another? Put even more plainly, should the Church support the government taking one person's property and giving it to another to whom it doesn't belong? Such an act done privately is called theft.

The pope might say the welfare state reflects the will of the people. Would that mean the Church interprets God's commandment to Moses "Thou shalt not steal" as not an absolute, but as "Thou shalt not steal unless you got a majority vote in Parliament or Congress"?

I share Pope Benedict's desire to assist our fellow man in need. But I believe that reaching into one's own pocket to do so is praiseworthy and laudable. Reaching into another's pocket to assist one's fellow man in need is despicable and worthy of condemnation.

Walter E. Williams is a professor of economics at George Mason University and a nationally syndicated columnist.

No comments:

Post a Comment